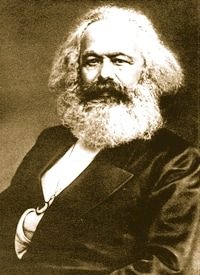

At the end of section two of Marx’s Communist Manifesto, in addition to calling for the abolition of private property and the centralization of the means of production in the hands of the state, he petitioned for “a heavy progressive or graduated income tax.”

This is based on the Marxist dictum (that many Americans think appears in the Constitution): “From each according to his ability, to each according to his needs,” and on Marx’s mistaken notion of the result of the inequality of wealth, as we see in his Das Kapital: “In proportion as capital accumulates, the lot of the labourer, be his payment high or low, must grow worse…. Accumulation of wealth at one pole is at the same time accumulation of misery, agony of toil, slavery, ignorance, brutality, mental degradation at the opposite pole.”

Yet, from its very beginning, the U.S. tax code has sought to soak “the rich” with “a heavy progressive or graduated income tax.”

The income tax began with a 1 percent tax on taxable income above $3,000 followed by a series of surcharges of up to 6 percent applied to higher incomes. The maximum rate of 7 percent was applied to taxable income over $500,000. In addition, there was an exemption of $3,000 for a single person and $4,000 for a married couple.

The tax rate in the highest tax bracket rapidly increased, up to 67 percent in 1917 and 77 percent in 1918, and then rose to 81 percent in 1940, 88 percent in 1942, and a whopping 94 percent in 1944. In 1942, the top rate began applying to all incomes over $200,000 instead of $5 million as it had previously. After dropping briefly, the top rate stayed near or above 90 percent between 1950 and 1963.

Under President Reagan, the top marginal tax rate fell from 70 down to 50 percent, and then down to 38.5 before stopping at 28 percent. The tax brackets were also eventually reduced to just two. This doesn’t mean that the government cut spending and balanced its budgets during the 1980s like it should have, or that it didn’t raise other taxes like it shouldn’t have, but the fact remains that the highest tax bracket fell to under 30 percent for the first time since 1931.

After both rates and brackets increased during the Bush Sr. and Clinton years, the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) and the Jobs and Growth Tax Relief Reconciliation Act of 2003 (JGTRRA) gave us our current system of six brackets of 10, 15, 25, 28, 33, and 35 percent. The lowest bracket was scheduled to be eliminated, and four of the other rates were scheduled to rise, giving us five brackets of 15, 28, 31, 26, and 39.6 percent, were it not for the two-year extension of the Bush tax cuts enacted at the end of 2010.

But although the tax brackets have fallen in number and amount since their height in the 1960s, this does not mean that “the rich” have stopped paying their “fair share.”

According to the most recently released IRS data, in tax year 2009, the top 1 percent of taxpayers (in terms of adjusted gross income) paid 36.73 percent of all federal income taxes. The top 5 percent of taxpayers paid 58.66 percent. The top 10 percent of taxpayers paid 70.47. The top 25 percent of taxpayers paid 87.3 percent of the taxes, and the top 50 percent paid a whopping 97.75 percent.

There are a number of ways in which the tax code is designed to punish “the rich”; that is, punish success and reward those who do nothing but have children.

Consider the example of a typical American family with two children. Because of the progressive nature of the tax code, for tax year 2011, this family could make $45,399 and still pay nothing in federal income taxes. This is because the $11,600 standard deduction and $14,800 deduction for personal exemptions reduces this family’s taxable income to $18,999. This leaves a tax liability of $1,996, which is reduced to zero thanks to a $1,000 per child tax credit.

But it’s not just the progressive tax brackets that punish “the rich” and favor “the poor.” A tax credit is a dollar-for-dollar reduction of the amount of income tax owed. It may reduce the tax owed to zero, but if there is no taxable income to begin with, then no credit can be taken.

However, some tax credits are refundable; that is, you still get the credit even if you don’t have any tax liability. These refundable credits include the adoption credit (up to $13,360 per child), the additional child tax credit (up to $1,000 per child), the American Opportunity credit (up to $2,500 per student, with 40 percent of the credit being refundable), and the earned income credit (up to $5,751 for three children).

Refundable tax credits can amount to a significant part of a family’s income. Consider once again a typical American family with two children. For tax year 2011, they can make up to $26,404 and not only owe nothing in taxes, but get a $5,112 earned income credit plus a $1,000 per child additional tax credit refunded to them. This effectively gives them an income of $33,516.

This artificial income of $33,516 is much better than a real income of $33,516, and for three reasons. First, the family’s income is still $26,404 when qualifying for public assistance. Second, no income tax is due on income from refundable tax credits. And three, the taxable wages for Social Security and Medicare are only $26,404.

Another way “the rich” are targeted is through the phase-out of tax deductions and credits. This means that the value of the credit is reduced as income rises. And in some cases, the credit is disallowed altogether.

The $1,000 child tax credit is reduced by 5 percent for each $1,000, or part of that amount, above the phase-out amount of $75,000 ($110,000 if married filing jointly).

The child and dependent care credit is 35 percent of expenses up to a maximum credit amount of $3,000 for one child and $6,000 for two or more children. But this is only if you make up to $15,000. The percentage is reduced by 1 percent (down to a minimum of 20 percent) for each $2,000, or part of that amount, of income above $15,000.

The retirement savings contributions credit (up to $1,000 or $2,000 if married filing jointly) cannot be claimed once adjusted gross income exceeds $28,250 ($56,500 if married filing jointly).

If you itemize deductions and your adjusted gross income is more than $109,000, you cannot deduct your mortgage insurance premiums.

IRA contributions for those covered by a retirement plan are reduced when modified adjusted gross income goes over $56,000 ($66,000 for married filing jointly) and not deductible at all once their modified adjusted gross income reaches $66,000 ($110,000 if married filing jointly).

Education credits and deductions take a hit as well.

Up to $2,500 of student loan interest is tax deductible. However, this deduction begins to be phased out once your modified adjusted gross income exceeds $60,000 ($120,000 if married filing jointly) and is not allowed once your income reaches $75,000 ($150,000 if married filing jointly).

No American opportunity credit (maximum of $2,500 for each student) for qualified educational expenses can be claimed if your modified adjusted gross income reaches $90,000 ($180,000 if married filing jointly). And a phase-out of the credit begins at $80,000 ($160,000 if married filing jointly).

No lifetime learning credit (maximum of $2,000) for qualified educational expenses can be claimed if your modified adjusted gross income reaches $61,000 ($122,000 if married filing jointly). And a phase-out of the credit begins at $51,000 ($102,000 if married filing jointly).

The tuition and fees deduction of up to $4,000 per tax return for qualified educational expenses is lowered to a maximum of $2,000 once your modified adjusted gross income exceeds $65,000 ($130,000 if married filing jointly) and eliminated if your income exceeds $80,000 ($160,000 if married filing jointly).

The phase-outs also apply to the strictly refundable tax credits.

If you have three or more children and make over $43,997 ($49,077 if married filing jointly), two children and make over $40,963 ($46,043 if married filing jointly), or one child and make over $36,051 ($41,131 if married filing jointly), you are not eligible to claim the earned income credit. And the maximum amount of the credit drops steadily once your income exceeds $21,800.

To take the adoption credit, your modified adjusted gross income cannot exceed $225,210. And the amount of your credit is reduced once your income exceeds $185,210.

The income phase-out for the additional child tax credit begins, like the child tax credit, at $75,000 ($110,000 if married filing jointly).

No wonder the top 10 percent of income earners in America pay over 70 percent of the taxes! The brackets punish them, the phase-outs penalize them, and the refundable tax credits add insult to the injury of “a heavy progressive or graduated income tax.” There is nothing American about the U.S. tax code. It is straight out of the Communist Manifesto.

According to a recent report by the Heritage Foundation: “The percentage of people who do not pay federal income taxes, and who are not claimed as dependents by someone who does pay them, jumped from 14.8 percent in 1984 to 49.5 percent in 2009.” This means that about half of all Americans don’t pay any income taxes.

But the emphasis placed by some conservatives on the lack of taxes paid by some Americans is getting the whole issue backward. The solution is not a national sales tax or flat tax that forces all Americans to pay some arbitrary “fair share” and actually perpetuates the progressivity of the tax code. And neither is it to eliminate all the deductions and credits in order to punish those with low incomes by increasing their taxes.

The solution is to decrease the tax burden of those who are paying the taxes now by eliminating the income tax altogether. This is the Ron Paul approach. In a recent NPR interview, congressman and Republican presidential candidate Paul put the emphasis where it belongs — keeping as much tax revenue out of the hands of the federal government as possible. In reply to the question, “Do you believe that income derived from dividends interest or capital gains should be taxed at a lower rate than income earned from a salary or commissions?,” Dr. Paul said:

Well, I’d like to have everybody taxed at the same rate, and of course, my goal is to get as close to zero as possible, because there was a time in our history when we didn’t have income taxes. But when government takes it upon themselves to do so much, you have to have a tax code. But if you’re going to be the policemen of the world and run all these wars, you have to have a tax code. But as far as what the rates should be, I think it should be as low as possible for — for everybody.

The only reason it appears that we can’t do without an income tax is that Congress has an insatiable desire to spend money. But if the functions of the federal government were strictly limited to only those authorized by the Constitution, the government could be funded by user fees, land sales, excise taxes, and revenue tariffs (like it was from 1789 to 1913), or these things in combination with a lottery or donations. Don’t laugh, in fiscal year 2011, $3,277,369.23 was given by Americans to the federal government for the purpose of debt reduction. A small amount, yes, but only alongside the gargantuan trillion-dollar budgets of the last twenty years.