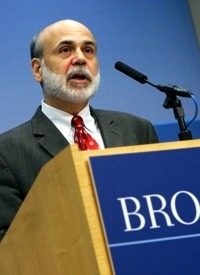

Ben Bernanke, Federal Reserve Chairman, expressed confidence that the worst recession since the 1930s is almost over. In a speech before a Brookings Institution audience Tuesday morning Bernanke made the guardedly optimistic assessment that the economy likely had begun to grow again. He added that growth would be too slow to prevent unemployment from continuing to rise.

This is essentially the same prediction he made at Jackson Hole, Wyoming, at a Fed conference last month where he stated that economic activity appears to be “leveling out” after the sharp declines of the last two quarters of last year and the first quarter of this year.

Bernanke told a questioner, “From a technical perspective, the recession is very likely over at this point. It’s still going to feel like a very weak economy for some time because many people will still find that their job security and their employment status is not what they wish it was.”

Unemployment stands at a 26-year high of 9.7 percent according to the federal government’s official figure, which does not count discouraged workers who haven’t sought work in the past four weeks or those who have left the labor force by returning to school, and which counts both part-time and full-time workers as employed for statistical purposes. If discouraged workers and former workers who have gone back to school are counted, then the unemployment measure rises to around 17 percent.

Bernanke acknowledged that the official unemployment figure will reach 10 percent before the end of this year. “Unfortunately,” he said, “unemployment will be slow to come down. It will come down, but it may take some time. Obviously, that’s a very serious concern.”

This recession has claimed 6.9 million jobs in all since the final quarter of 2007. Evidence of trouble ahead in the economy goes back considerably further, with the increasing number of bankruptcies and foreclosures — and possibly to March 23, 2006, the day the Fed stopped reporting its M3 aggregate.

Bernanke described the “ongoing headwinds” that are slowing economic growth as hard-to-obtain credit for businesses and consumers; and consumers saving rather than spending, and trimming their debt. He spoke of pending “comprehensive reform” to be taken by Congress, rewriting the rule book so as to prevent a repeat of the near-meltdown of U.S. financial system just under a year ago. On Monday, President Obama urged Congress to enact legislation this year.

Some analysts are unsure that the U.S. economy is moving out of its doldrums. Worries exist over the continued plunge of housing prices. Karen Weaver of Deutsche Bank expressed doubts Tuesday that national home prices would end their slide before next summer. Declines in home prices can be expected in New York City, Salt Lake City, Fort Lauderdale, and Baltimore.

Those schooled by Austrian-school economists look to the methods the Federal Reserve has used in its effort to manage our way out of this recession — to wit, printing money — and are skeptical that we are seeing anything other than the slow creation of yet another bubble which, in order to counteract the effects of last year’s debacle and restore an appearance of prosperity, would have to be the largest in history. Bernanke, with as much confidence in the Fed’s methods as Alan Greenspan had, is taking a huge gamble in ignoring the Austrian perspective and in implying, however indirectly, that the path back to prosperity runs through the money-printing mechanism.

If the Austrian-school perspective is right, our economic woes may not only not be over, they may have just barely begun. They will not be over until the micro-managers in government of U.S. financial affairs get out of the way and allow the economic system to purge itself of over three decades of malinvestments. It would be a very rough ride, but only then will we see the beginnings of a genuine economic recovery that would lead to genuine growth instead of a new round of pseudo-prosperity empowered by a credit bubble.

Photo: AP Images