In 1974, economist Arthur Laffer scribbled the tenets of a new economic theory on a napkin while at dinner with Ford administration officials Donald Rumsfeld and Dick Cheney and Wall Street Journal writer Jude Wanniski. The resulting “Laffer Curve” sketch helped launch the supply-side revolution, a set of macroeconomic principles central to Ronald Reagan’s presidency.

Fast forward to the present. Years of massive, repeated doses of Keynesian economics have supplanted supply-side principles, with economic growth slowing to a veritable crawl as a result. And now, a real-world endgame is potentially at hand, as negative interest rates have begun to spread throughout the western world. What might negative interest rates do to supply, demand, and the economy in general if they reach our shores?

Supply-side Economics

First, let’s look at the two approaches. Auburn University describes supply-side economics as follows:

A school of thought within the economics profession emphasizing that the main source of a country’s economic growth is constant improvement in the efficiency with which resources are allocated for production. While the policy recommendations of the rival Keynesian school tend to focus almost entirely on what government can do to stimulate or restrain aggregate demand in the short-run so as to even out the business cycle, supply-side policy analysts focus on barriers to higher productivity — identifying ways in which the government can promote faster economic growth over the long haul by removing impediments to the supply of, and efficient use of, the factors of production. Supply-siders believe that unwise provisions of the tax laws (and especially high marginal rates of personal and corporate income taxation) produce very damaging incentives that lead people to work less and to invest less (and to do both less efficiently) than they otherwise would. Supply-side policy recommendations typically include deregulation of heavily regulated industries, promotion of greater competition through lowering protectionist barriers to international trade, and measures to repeal special subsidies and tax loopholes targeting particular industries in favor of lower and more uniform tax rates across the board.

Supply-side economics were popularized during the Reagan administration. In terms of economic growth, history shows just how successful Reaganomics were, with GDP expanding an average of 4.9 percent in the years following the 1980-82 recession. By contrast, Obama’s economic policies have yet to achieve 3.0 percent in any of the years of his presidency.

Keynesian Economics

Keynesian economics focus on government manipulation of demand. Investopedia explains the theory as follows:

An economic theory of total spending in the economy and its effects on output and inflation. Keynesian economics was developed by the British economist John Maynard Keynes during the 1930s in an attempt to understand the Great Depression. Keynes advocated increased government expenditures and lower taxes to stimulate demand and pull the global economy out of the Depression. Subsequently, the term “Keynesian economics” was used to refer to the concept that optimal economic performance could be achieved — and economic slumps prevented — by influencing aggregate demand through activist stabilization and economic intervention policies by the government. Keynesian economics is considered to be a “demand-side” theory that focuses on changes in the economy over the short run.

Negative Interest Rates

By definition, Keynesian economics require an active external role — in this case, governmental as well as via the Federal Reserve — in an attempt to stimulate demand. Both have doubled down on their efforts in recent years.

It hasn’t worked. The economy has grown at a historically lackluster rate since the end of the Great Recession, and if the one-percent growth posted during the first half of the year is a guide, may be edging toward yet another recession. Likewise, other countries around the world have followed America’s lead by lowering interest rates to stoke economic growth. Some have become desperate enough to push rates into the negative.

Investopedia defines negative interest rates accordingly:

A negative interest rate means the central bank and perhaps private banks will charge negative interest: instead of receiving money on deposits, depositors must pay regularly to keep their money with the bank. This is intended to incentivize banks to lend money more freely and businesses and individuals to invest, lend, and spend money rather than pay a fee to keep it safe.

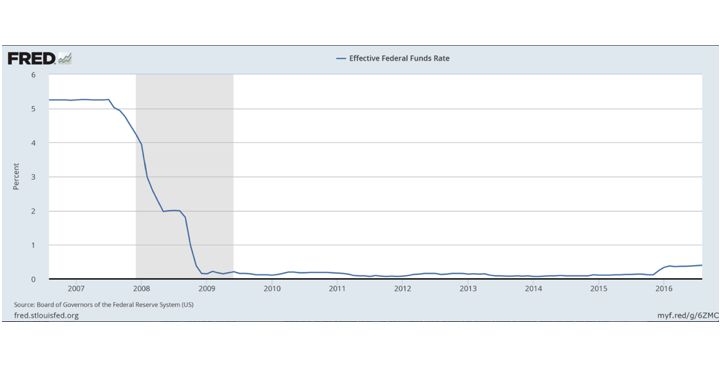

So there you have it. The central bank becomes so desperate to stimulate spending that even zero percent savings rates won’t do the trick. Savers might actually be charged to leave their money in the bank. And it’s not just theoretical: Japan, Switzerland, Sweden, Ireland, Latvia, Portugal, Lithuania, and Germany have seen one or more of their benchmark interest rates dip into the negative in recent years. (The following chart shows the interest rate that a bank holding funds at the Federal Reserve charges another bank for borrowing the funds.)

How Negative Interest Rates Would Damage the Economy

Although the housing sector and the automobile industry have benefited, the overall impacts of a perpetually low interest rate environment are decidedly poor. Buoyed by cheap interest rates, consumer spending has been relatively strong, with household spending increasing by 4.2 percent in the second quarter. However, businesses are in decline, reducing inventory levels and limiting big-ticket purchases. Overall, consumers contributed 2.83 percentage points to second-quarter growth, and businesses subtracted 1.61 percentage points. The resulting 4.4-point spread is the largest since 2001, and negative rates would only serve to drive a wedge even further into that divide. The evidence suggests that demand is positively impacted, but in a fragile, unsustainable way.

On the production side, negative interest rates exacerbate the currency manipulation already rampant across the globe. Low or negative rates serve to devalue a country’s currency, which (all things considered) improves the attractiveness of its exports. With the U.S. dollar serving as the world’s reserve currency and remaining a bellwether during turbulent times, it gains strength while other currencies falter. Negative interest rates would further strengthen the dollar, depressing American exporting and causing the economy to bleed more manufacturing jobs in the process.

End the Fiat Currency

The solution to wayward Keynesian malfeasance is decidedly simple: It’s time to put the era of fiat currency to an inglorious end. The gold standard was utilized up to the Nixon administration, and should be re-instituted once again. It’s the only way to stop the government from committing harikari.

As Alan Greenspan once said, “An almost hysterical antagonism toward the gold standard is one issue which unites statists of all persuasions. They seem to sense that gold and economic freedom are inseparable.”