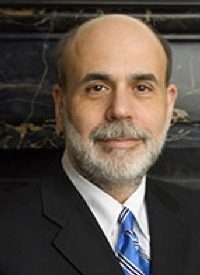

The time has come, Paulson and Bernanke informed the House committee, to “consolidate” the regulation of investment banks and other comparatively unregulated financial entities, to bring them under a stringent web of federal regulations and bailout guarantees similar to those long endured by commercial banks. “Congress may wish to consider whether new tools are needed for ensuring an orderly liquidation of a systemically important securities firm that is on the verge of bankruptcy, together with a more formal process for deciding when to use those tools,” Bernanke proposed. “Tools,” of course, is federalese for “powers,” and Secretary Paulson, reaffirming his commitment to the U.S. Treasury’s “Blueprint for a Modernized Financial Structure” released last March, was not shy as to what some of these “tools” might entail:

Americans have come to expect the Federal Reserve to step in to avert events that pose unacceptable systemic risk. But the Fed does not have the clear statutory authority nor the mandate to do this; therefore we should consider how to most appropriately give the Federal Reserve the authority to access necessary information from complex financial institutions — whether it is a commercial bank, an investment bank, a hedge fund, or another type of financial institution — and the tools to intervene to mitigate systemic risk in advance of a crisis.

In actuality, most “Americans” have little regard for the Federal Reserve one way or the other. Wealthy shareholders of foundering financial corporations, on the other hand, have welcomed the Fed’s newfound largesse, with the likes of Bear Stearns and other investment banks happy to avail themselves of Federal Reserve loans since the Fed first made such funds available earlier this year.

The Federal Reserve and the Treasury Department are taking advantage of the acute financial crisis to expand federal control over the entire financial service industry. Leaders in the financial industry, for their part, are happy to endure new levels of federal regulatory scrutiny in exchange for taxpayer-funded guarantees against insolvency.