More tough times lie ahead, according to a report on the state of the economy just released by the Congressional Budget Office (CBO). Unemployment is likely to remain high, not returning to 5 percent or lower until at least 2014, while this year’s budget deficit will hit $1.342 trillion, the second highest ever.

“Putting the nation on a sustainable fiscal course will require policymakers to restrain the growth of spending substantially, raise revenues significantly above their average percentage of GDP of the past 40 years, or a combination of both,” the CBO wrote. Translation: the federal government will either have to cut expenditures or raise taxes to cover ballooning deficits. Any guesses as to which option federal lawmakers are likely to prefer?

Since the onset of the Great Recession, governments have chosen two approaches to deal with unsustainable levels of public debt: so-called “austerity measures” and borrowing and spending more money in hopes of papering over fiscal woes. A number of European countries, including Greece, Ireland, and Spain, have chosen the former course, slashing social programs and other high-ticket items, and laying off government workers. The United States — so far — has chosen the latter, laying out trillions of new dollars in various attempts to stimulate anemic borrowing and spending.

Both Republican President George W. Bush and Democratic President Barack Obama have shown no inclination to rein in federal spending; both passed gargantuan spending bills in the name of fiscal stimulus and both doled out untold billons in bailout monies. The result, as should surprise no one who has ever owned a piggy bank, has been: more debt, no jobs creation, and minimal economic growth. There is, in other words, no sign that we are anywhere close to returning to the go-go ’80s and ’90s, and every likelihood that our country, and much of the rest of the developed world, is in the grip of a generational economic downturn.

Some observers have a bleaker outlook than the CBO. The “worst case scenario,” according to Egon von Greyerz of Matterhorn Asset Management in Zurich, writing on August 16, is that the ongoing correction is actually in its infancy, and the entire unwinding of generations of accumulated funny money and excess credit may take a century or more to accomplish. Greyerz’ comments are worth reproducing in some detail:

The world economy will soon go into an accelerated and precipitous decline which will make the 2007 to early 2009 downturn seem like a walk in the park. The world financial system has temporarily been on life support by trillions of printed dollars that governments call money. But the effect of this massive money printing is ephemeral since it is not possible to save a world economy built on worthless paper by creating more of the same. Nevertheless, governments will continue to print since this is the only remedy they know. Therefore, we are soon likely to enter a phase of money printing of a magnitude that the world has never experienced. But this will not save the Western World which is likely to go in to a decline lasting at least 20 years but most probably a lot longer.

The hyperinflationary depression that many western countries, including the US and the UK, will experience is likely to mark the end of an era that has lasted over 200 years since the industrial revolution. A major part of the growth in the last 100 years and especially in the last 40 years has been built on an unsustainable build-up of debt levels. These debt levels will continue to swell for another few years until the coming hyperinflation in the West leads to a destruction of real asset values and a debt implosion….

Until the early 1970s the growth in credit to GDP had been going up gradually since the creation of the Fed in 1913. But from 1971 when Nixon abolished gold backing of the dollar, virtually all of the growth in the Western world has come from the massive increase in credit rather than from real growth of the economy. The US consumer price index was stable for 200 years until the early 1900s. From 1971 to 2010 CPI went up by almost 500%. The reason for this is uncontrolled credit creation and money printing. Total US debt went from $9 trillion in 1971 to $59 trillion today and this excludes unfunded liabilities of anywhere from $70 to $110 trillion. US nominal GDP went from $1.1 trillion to $14.5 trillion between 1971 and 2010. So it has taken an increase in borrowings of $50 trillion to produce an increase in annual GDP of $13 trillion over a 40 year period. Without this massive increase in debt, the US would probably have had negative growth for most of the last 39 years.

The coming hyperinflationary depression and the credit and asset implosion that is likely to follow will most probably lead to the end of a 200 year era of growth for the Western world. If only the excesses from the 1970s were corrected we might have a circa 20 year decline. But more likely we will correct the era all the way back from the industrial revolution in the 18th century and this could take 100 years or more.

Scary stuff indeed, but who’s right? Are we at the cusp of a new era betokening nothing less than an economic Götterdämmerung for the West, or will the Great Recession eventually, if slowly, give way to another cycle of boom and prosperity? It’s impossible to tell, but the long range forecast is likely to resemble Mr. Greyerz’ gloomy prognosis more than the CBO’s relatively benign assessment if our government continues to try to borrow and spend its way out of crisis.

There are historical precedents for the “generations to recover” scenario. France spent its way into bankruptcy in the 17th century and didn’t escape the cycle of national insolvency and civil unrest until late in the 19th. Turkey under the Ottomans was bankrupt and impotent by the mid-19th century (the “sick man of Europe,” Turkey was derisively styled), finally had her impotent empire dismembered after World War I, and did not recover into the relatively robust prosperity it enjoys today until a couple of decades ago. Argentina, one of the world’s largest economies a century ago, attracted — like the U.S. — a huge influx of immigrants in the late 19th and early 20th centuries, only to be ruined by Juan Peron and a succession of military juntas. To this day, Argentina remains an economic basket case. As for great economies that went into decline and never recovered, the Western Roman Empire and Venice are instructive examples.

There is thus no reason to expect that America is immune to the ravages of such trans-generational declines. But our real problem now is not economic but political; we still have the resources to cancel our debts and recover economically, but our current crop of political leaders obviously lacks the political will to do what must be done. Unless we elect leaders determined to stop repeating the mistakes of the past, we will likely experience what the French, Turks, and many other once-proud nations endured before us.

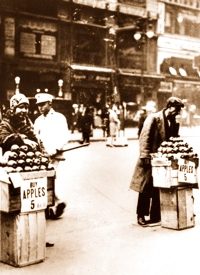

Photo: Two unemployed street vendors try to earn a living selling apples on the streets in New York City on Nov. 30, 1930 during the first Depression: AP Images