Back in August, when Standard & Poor’s downgraded the U.S. credit rating for the first time in history, from AAA to AA+, the Obama administration was disgruntled and fearful of how such a move would impact economic growth. Once the initial shock of the maneuver passed, however, Washington returned to its business-as-usual mentality. Now, however, it seems that this period will be short-lived, as another downgrade is expected.

According to Bank of America/Merrill Lynch’s Ethan Harris:

We expect a moderate slowdown in the beginning of next year, as two small policy shocks — another debt downgrade and fiscal tightening — hit the economy. The “not-so-super” Deficit Commission is very unlikely to come up with a credible deficit-reduction plan. The committee is more divided than the overall Congress. Since the fall-back plan is sharp cuts in discretionary spending, the whole point of the Committee is to put taxes and entitlements on the table. However, all the Republican members have signed the Norquist “no taxes” pledge and with taxes off the table it is hard to imagine the liberal Democrats on the Committee agreeing to significant entitlement cuts.

The credit rating agencies have strongly suggested that further rating cuts are likely if Congress does not come up with a credible long-run plan. Hence, we expect at least one credit downgrade in late November or early December when the super Committee crashes.

Harris went on to predict a 2.7-percent GDP for the third quarter, the actual figures of which are expected to be released by the end of this week. He also projected a 2.3-percent GDP for the fourth quarter. He expects that the small upswing will be followed by yet another downturn.

The next downgrade will likely come from either Moody’s or Fitch, and will result from the same concerns over the government’s rising debt which prompted the Standard & Poor’s downgrade in August.

Reuters explains that the bipartison congressional group formed to address the debt — the so-called “super-committee” — has done little to assuage the concerns raised by the credit agencies. It must break an impasse between Republicans and Democrats by November 23 in order to reach a deal to reduce the U.S. deficit by at least $1.2 trillion. If that majority does not reach a decision by 2013, a round of cuts will automatically go into effect. The cuts, however, are relatively weak, in that most concern discretionary spending.

Whether the predictions will come to fruition is debatable at the moment. Moody’s Investors Service, which has given the United States a negative outlook on its AAA rating, indicates that it will be examining a number of other factors — including the results of the 2012 election and the expiration of the Bush-era tax cuts in 2012 — before it decides on the ratings. A failure on the part of the super committee to come to an agreement will not be the only factor involved in the decision.

“It’s not that we’re waiting just for this committee to decide on the rating,” said Steven Hess.

Moody’s has also indicated that it has not ruled out the possibility of an early move on U.S. ratings if the economy slips into recession.

Fitch, on the other hand, continues to give the United States a positive outlook on its AAA rating; therefore, if it were to make any move, it would likely first change its positive outlook to negative before making a credit rating downgrade. Fitch’s latest report on the United States explains that an outlook revision would be determined based on economic recovery and on a failure by the bipartisan committee to reach an agreement on at least $1.2 billion in deficit-reduction measures.

Meanwhile, Austrian School financial expert Peter Schiff, a former economic adviser to Ron Paul, contends that all the credit outlooks are far too optimistic:

[S&P] did the right thing and downgraded them. I think the only thing S&P did wrong is that they didn’t downgrade them far enough. They did leave it at an AA+ with a negative watch, and they did mention that they might bring it down to an AA in the next couple of years if the fiscal situation deteriorates, which it surely will, but I don’t think the U.S. deserves to be AA+. After all, New Zealand is AA+. The New Zealand dollar is making record highs. The net public debt in New Zealand is about 10 percent of the GDP. They’re far more solvent than the United States. I would much rather buy New Zealand government bonds than U.S. treasuries.

The predictions by Ethan Harris seem to corroborate those of Schiff in August at the time that S&P downgraded the U.S. credit rating. Schiff declared at the time that the United States was on the “cusp of a brand new recession” and warned that it would be significantly worse than the last one because the country would be entering it with already-high unemployment numbers and interest rates already at 0. He also indicated that the most likely response would be for the Federal Reserve to print even more money, naturally further inflating the dollar.

Forbes contends that the announcement by Harris will likely put a damper on spending for the upcoming holiday season, even as 45 percent of consumers have already indicated that they will spend less money during this season than they did in 2010, according to a PriceGrabber survey. The National Retail Federation’s 2011 Holiday Consumer Intentions and Actions survey reports similar findings.

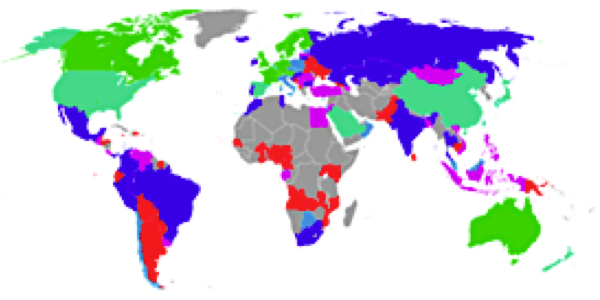

Graphic: Credit rating of governments around the world by Standard & Poor’s

Graphic: Credit rating of governments around the world by Standard & Poor’s