When Peter G. Peterson sold his interest in his investment company the Blackstone Group in 2007, he took $1 billion of his gains to fund his foundation, which has concentrated on creating awareness of the dangers of deficits and the national debt in the United States. One of his recent grantees is The Heritage Foundation, which was tasked with the challenge of developing a plan and a strategy to put the country back on a sustainable and responsible fiscal path. Similar grants were given to The American Enterprise Institute, the Bipartisan Policy Center, the Center for American Progress, the Economic Policy Institute, and the Roosevelt Institute Campus Network.

“Saving the American Dream” is Heritage’s entry, which will be presented at the Peterson Foundation’s Fiscal Summit later this month.

The challenge was daunting and the result is worthy of consideration as it offers new insights and strategies to get the country’s fiscal problems under control. Everything (except defense spending) was on the table including entitlements (Social Security, Medicare, and Medicaid), the labyrinthine income tax code, and the extra-legal and unconstitutional agencies known by some as the “fourth” branch of government.

Edwin Feulner, President of The Heritage Foundation, was sanguine about his plan:

It balances the nation’s budget within a decade — and keeps it balanced. It reduces the debt and cuts the government in half. It eliminates government-mandated health care and fully funds our national defense. It squarely confronts Social Security, Medicare and Medicaid, the three so-called entitlement programs, which together account for 43 percent of federal spending today…

The good news is that we can do this. We can guarantee economic security to middle-aged and older Americans even as we reduce the crippling debt that we have piled onto the shoulders of the young.

“Saving the American Dream” promises to

1. Balance the federal budget within a decade and keep it balanced forever

2. Reduce the national debt to 30 percent of GDP within 25 years

3. Cut the size of the federal government in half in 25 years

4. Replace the impossibly complex current tax code with a completely new simpler tax system

5. Ensure full funding for national defense

6. Eliminate ObamaCare

7. Create a new health care system based on individual choice and competition

8. Restructure both Social Security and Medicare to be permanently sustainable, and

9. Provide new incentives for citizens to save and invest so that they will be increasingly less dependent upon these programs.

Social Security

The Dream reconfigures Social Security into a flat payment system whereby higher income retirees receive a lower amount and affluent retirees receive none at all. Retirement age will be raised and then indexed for each individual’s life expectancy. It will be actuarially sound (for the first time in history), with tax benefits enjoyed by those who wish to work longer. In two years, a new savings plan will be introduced into which workers will contribute six percent of their salary, which they will own and control personally.

Medicare

The Dream transforms Medicare into a plan nearly identical to the Federal Employees Health Benefits Program (FEHBP) now enjoyed by members of Congress and federal employees. This looks very similar to the plan offered by Rep. Paul Ryan (R-Wisc.) in that seniors will receive a “contribution” from the government which they can then use to purchase private coverage for themselves from a variety of options, based upon their personal circumstances. As noted in the Dream plan, “By moving to a premium-support program, Congress can introduce the powerful forces of consumer choice and competition into Medicare, forcing health plans and providers to deliver value for taxpayer and beneficiary dollars.”

Health Care for Families

The Dream begins by repealing ObamaCare, and then

• Removes barriers to the individual purchase of health insurance such as existing limits on interstate purchases;

• Develops mechanisms to make it easier for hard-to-insure individuals to obtain coverage

• Sets up new pooling arrangements

• Supports state-developed initiatives built around private, consumer-centered, market-based reforms

Other Spending Cuts

The Dream reduces non-defense discretionary spending such as foreign aid, K-12 education, transportation, health research, housing, community development, and veterans’ health care to half its current level in 10 years. In addition, anti-poverty, agriculture, and education programs will be significantly reformed so that non-defense discretionary spending is brought back to 2008 levels. Highway taxes will be directed to the states without the expensive federal middle-man so that they can spend those monies based upon their own priorities and not upon directives and mandates from Washington. Federal funding for passenger rail (Amtrak), high-speed rail boondoggles, and subsidies to already-profitable freight railroads will be eliminated altogether.

Asset Sales

Presently the federal government owns 650 million acres of land plus a million buildings and electrical utilities such as the Tennessee Valley Authority. As noted in the Washington Post, “No one advocates selling Yellowstone, but why … should the federal government be in the electricity business?” The Dream proposes selling at least a portion of these assets, which has the potential of raising more than $250 billion and would begin reducing the government’s operating deficit and debt, which would reduce interest costs.

Tax Reform

Authors of the Dream point out:

For decades, Congresses have tweaked and twisted a fundamentally flawed system into knots, each time creating two new problems while attempting to solve an old one. The income tax was a poor choice from the outset, and Congress after Congress has consistently made it worse.

The Dream will switch from the present system to a flat-tax system which would replace all federal income taxes, all payroll taxes, the death tax, and virtually all excise taxes. The flat rate would apply to earned income after deducting all savings, thus providing incentive for workers to save on their own. All gains on those savings would also be free of income tax until they are withdrawn and spent.

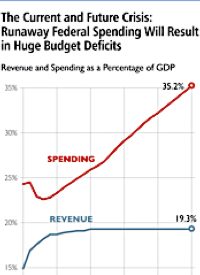

The Dream is 46 pages long, filled with the necessary charts and graphs showing “before” and “after” implementation results. It represents the thoughtful, insightful, and careful analysis one expects from The Heritage Foundation. It is light on defense spending, and continues unconstitutional interference in many areas, only with a lighter touch. When added to the mix of other proposals to rein in out-of-control spending, it is hoped that some of the best of these proposals will bubble to the surface, and begin to have an impact on that spending, before such spending and debt simply overwhelm any reasonable attempts to do so.

Graphic: Chart from The Heritage Foundation’s “Saving the American Dream.”