Watching Wall Street: Money Never Sleeps is analogous to viewing James Cameron’s 1997 hit, The Titanic. Both films generate the same sense of impending doom, rendering moviegoers with a feeling of helplessness as they sit and watch a tragedy befall that potentially could have been avoided. Where Wall Street differs from The Titanic, however, is in the realization that the disaster is continuing to unfold today. Oliver Stone’s Wall Street: Money Never Sleeps encapsulates the 2008 market crash and depicts the adage “The love of money is the root of all kinds of evil.” Audiences may be surprised that the film does not trash the George W. Bush administration, considering Stone’s directorship.

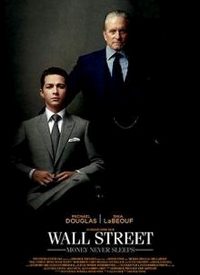

Set in 2008 when the economy began to show signs of disaster, the movie depicts young Wall Street trader Jake Moore (Shia LaBeouf) as one who is clearly knowledgeable and adept at generating a profit, while trying his best to maintain his moral character. Aware that something in the market is amiss, Moore partners up with the disgraced former Wall Street corporate giant Gordon Gekko (Michael Douglas), who uses his expertise to assist Moore in alerting the financial community of the approaching crash. Gekko also happens to be the estranged father of Moore’s young fiancé, Winnie Gekko (Carey Mulligan).

Wall Street asks and answers a variety of questions, all of which address a significant theme in the film. For example, “What is the definition of insanity? Doing the same thing over and over again and expecting a different result.” Here, the film takes a very clear stance against the concept of “Too big to fail.” This is depicted in a variety of ways, from the most obvious example, the 2008 bailout, to something more personal — Moore continuing to bail out his mother, who makes radical real estate decisions. At one point, Moore says to his mother, “I cannot keep hemorrhaging money for your insanity,” to which several moviegoers at my theater audibly declared, “Amen.”

Yet the federal government not only hemorrhaged money to pay for all its profligate spending programs, but it is now hemorrhaging even more money to pay for bailout and stimulus programs that will supposedly solve problems created by the earlier hemorrhaging. Question: How does piling on more debt solve economic problems created by debt? Talk about insanity! Unfortunately, howerver, that question is not addressed in the movie.

But there is a question that is continuously addressed throughout the film, which appears in the title of Gordon Gekko’s book: Is Greed Good? The unfolding of the plot aptly answers that question, particularly since the film seems to take the stance that it was ultimately corporate greed that landed the American economy where it stands today. While there is certainly some truth to this claim, the movie unfortunately overlooks the key roles of the Federal Reserve and the government in blowing up the financial bubble via artificially low interest rates and easy money, encouraging the bad loans and business decisions that are now blamed on greed, and setting the stage for the bust that followed.

The film seems to take a very sympathetic approach to the Bush administration. In a conversation with his daughter, Gekko remarks that he “cannot blame the current administration” for the disastrous state of the economy, to which his very liberal daughter unexpectedly agrees. Later, when several corporate executives meet to discuss the possibility of bank bailouts, they note that the federal government could potentially pose an obstacle in their request for an $800 billion bailout. When approached for the money, the government official responds, “You’re talking socialism! I have been fighting against it all my life!” However, once the executives exaggerate the catastrophic effects of allowing the banks to fail, the federal government is coerced by fear into agreeing to the bailout, despite its reservations.

Of course, socialism in America did not begin with the recent bailouts. Also, government officials who want to grow Big Government do not have to be coerced into supporting socialism (regardless of what they might say to the contrary), since they surely understand that socialism, in reality, is not a share-the-wealth program but a control-the-wealth program. Nevertheless, I was surprised that the film was willing to admit that the government’s reaction to the economic catastrophe has moved America in the socialist direction.

The plot is thrilling while also evoking a feeling of dread in the audience as the downfall of the American economy is unveiled on screen. As the film progresses, each scene elaborates on the growing instability of the economic climate before probing further into the players behind the uncertainty — players in an organization dangerously close to resembling Goldman Sachs. Aware that the unfortunate reality of Wall Street: Money Never Sleeps is that it is not fiction, moviegoers may share the same queasiness I felt as the film unfolded; however, like me, they will find themselves unable to look away.

The acting throughout the film is well-executed. LaBeouf plays a believable idealistic power-player, who at times has difficulty aligning his morality with his desire to turn a profit. Likewise, his love for Winnie is evident in every glance and smile. Douglas is a guy everyone loves to hate, and while his character will make your skin crawl, you’ll find yourself inexplicably wanting to see more of him on screen.

Overall, Wall Street: Money Never Sleeps is a good way to spend two hours this weekend, though the film could be confusing at times to those who have not studied economics. On the upside, it is virtually devoid of sexuality and violence, with limited harsh language, but is rated PG-13 for adult themes.