Calling it a debt limit “suspension,” the House voted today to pass the “No Budget, No Pay Act,” a measure that will allow the federal government to continue to spend until May 19, at which time it will consider the issue once again. It also takes away any threat of a government shutdown which the GOP initially considered as a way to force the Obama administration to agree to spending cuts. At least for the moment.

The bill just passed today adds additional incentive for the House and Senate to come to terms on fiscal matters, placing the salary checks for each member of Congress in escrow until a budget agreement is reached, or until the end of the 113th Congress, whichever happens first. The bill requires a budget from the House and the Senate by April 15. Passed largely due to House Republican votes, the bill received criticism from some Democrats. As noted by CNN,

Most House Democrats, however, voted against the bill. Minority Leader Nancy Pelosi called the salary provision a “joke” and Minority Whip Steny Hoyer called the bill a “political gimmick” that perpetuates uncertainty.

But other leading Democrats said they would support the legislation because it takes the immediate threat of default off the table and divorces the debt ceiling from Republican demands for spending cuts.

Senate Majority Leader Harry Reid said the Senate would “seek to pass” the House bill.

President Obama will not oppose the bill if it reaches his desk, even though he would prefer a longer term debt ceiling increase, the White House said Tuesday.

Following the GOP’s huddle in Williamsburg, Virginia last week, it was decided more politically palatable to put off the debt ceiling debate until sequestration and the current budget resolution dates have passed. Without action by Congress, the $100 billion annual cuts in military and non-military spending will happen automatically starting March 1, while the temporary budget resolution to allow the government to operate in the meantime expires March 27.

This seems to have placated those most opposed to House Speaker John Boehner’s leadership, including Rep. Raul Labrador (R-Idaho), one of 12 members who tried to oust Boehner on the first day of the new Congress. He said, “I am actually okay with what [Boehner] is doing right now.” He thinks the House will have greater leverage by putting off the debt ceiling debate and letting sequestration hit automatically. Another House member, Rep. John Fleming (R-La.), bought the Obama administration’s position that using the debt ceiling as a hammer would force the government to default:

The problem with the debt ceiling is if we do not agree on that, then federal checks don’t go out, the military doesn’t get their pay.

What we’ve chosen to do [instead] is push that back behind the other two events.

With the debt ceiling debate put off until the middle of summer, perhaps as late as August, then Republicans feel they can just bide their time and let the March 1 sequestration cuts in government spending happen automatically. If the administration doesn’t want that, it will be up to them to come to the House with an alternate plan, putting the House in the driver’s seat. Fleming likes the leverage: “The cuts are going to happen anyway. The president can’t stop the cuts from happening. All he can do is hopefully work with us to get the cuts in a better place. So if we have to, we’ll let the [sequestration] cuts go into effect.”

The real donnybrook is likely to take place when the temporary budget resolution expires at the end of March. The House GOP thinks that is the time when they can get the spending cuts that the White House promised when the House caved in on the fiscal cliff resolution. At a breakfast on Tuesday, Rep. Paul Ryan (R-Wis.) said, “They got their revenue increases already. We have yet to get anything as a result of it.” He added:

We have a sequester kicking in on March 1, a continuing resolution [on the budget] expiring on March 27. We have budget cuts that, if the Senate decides to do its job this year, will come out in April.

These are the kinds of points we think force the kind of conversation we think we have to have.

When Ryan was asked about whether the coming confrontation that has only temporarily been avoided will continue to push down Congress’ approval ratings, he said wryly, “We don’t have much to lose, do we?”

With the continued maneuvering over government spending, the conversation in Washington is carefully avoiding the real issue: significant spending cuts of the size sufficient to make a difference. For example, even if the sequester is allowed to occur, the cuts will amount to only $100 billion a year, or less than 10 percent of the expected annual deficit, and less than one percent of the “official” national debt.

But as Professor Laurence Kotlikoff has taken pains to point out as far back as 2006, the United States is already nearly bankrupt, partly because no one is willing to admit to the real size of the national debt. In a paper prepared for the St. Louis Federal Reserve in August, 2006, Kotlikoff concluded:

Countries can and do go bankrupt. The United States, with its $65.9 trillion fiscal gap, seems clearly headed down that path. The country needs to stop shooting itself in the foot.

It needs to adopt generational accounting as its standard method of budgeting and fiscal analysis, and it needs to adopt fundamental tax, Social Security, and healthcare reforms that will redeem our children’s future.

Since then the real national debt has increased exponentially and now is $222 trillion, according to Kotlikoff.

All that appears to be coming out of Washington, then, can be seen for what it is: political maneuvering over trifles.

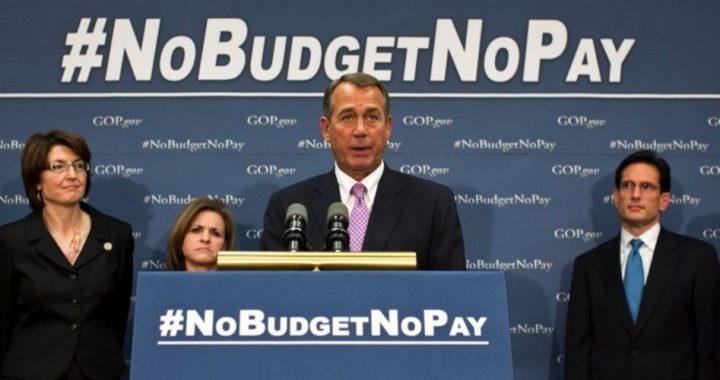

Photo of Speaker of the House Rep. John Boehner (R-Ohio) and GOP leadership speaking on budget issues Jan. 23: AP Images

A graduate of Cornell University and a former investment advisor, Bob is a regular contributor to The New American and blogs frequently at www.LightFromTheRight.com, primarily on economics and politics. He can be reached at [email protected]