World News

UN Climate Chief Would Like to See Smaller COPs in the Future

In 2023, some 84,000 souls participated in the COP28 climate conference in Dubai. People from all over the planet boarded carbon-spewing jets, flying...

German Law Permits Parents to Change Sex of Babies on Birth Docs, Punishes “Deadnaming”

The German parliament passed a law that permits parents to change the sex of newly born children on their birth certificates. ...

Read moreJapanese Research Uncovers “Significant Increases” in Cancer Deaths Linked to Third Covid Shot

A recent study by Japanese researchers found “significant excess mortalities” for all cancer types after third dose of mRNA Covid shots. ...

Read moreChina Announces Military Overhaul, Creates New Army Wing for Hybrid Warfare

On April 19, Chinese President Xi Jinping announced an overhaul of the Chinese military and the creation of the Information Support Force to...

Read moreAlleged Assassination Plot Against Zelensky Foiled; West Blames Russia, Russia Blames West

On April 19, former Russian President Dmitry Medvedev declared that recent Polish claims about the arrest of a man allegedly planning to kill...

Read moreRussia Says Kyiv Regime Untrustworthy, no Ceasefire in Ukraine

On April 19, during an interview with Russian radio stations Sputnik, Komsomolskaya Pravda, and Govorit Moskva, Russian Foreign Minister Sergey Lavrov said that...

Read moreLouisiana Bill Would Nullify UN, WHO, WEF

Legislation introduced in the Louisiana State Legislature would ban the implementation of any policies or edicts by the United Nations (UN), World Health...

Read moreReports Say U.S. Has Pledged not to Execute Assange

Washington has reportedly concurred with a range of conditions in response to the U.K. High Court’s request for “satisfactory assurances” about the potential...

Read moreU.S. Blocks Palestinian UN Membership Bid

On April 18, the United States blocked a UN Security Council (UNSC) resolution that would have acknowledged a Palestinian state, according to various...

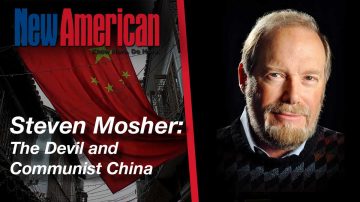

Read moreSteven Mosher on The Devil and Communist China

Noted China expert Steven Mosher discusses his new book, The Devil and Communist China: From Mao Down to Xi, with The New American‘s executive...

Read more“Make Europe Great Again”: Conservative Conference to Take Place in Romania Next Week

The New American magazine has been invited to cover the Make Europe Great Again (MEGA) conference, which will take place in Bucharest, Romania,...

Read moreUN Security Council to Vote April 19 on Palestinian Membership

The 15-member UN Security Council (UNSC) is poised to vote on April 19 on a Palestinian application for full UN membership, diplomats commented,...

Read moreUkraine Abruptly Backs Out of Black Sea Deal

On April 16, news outlet Reuters reported, citing four sources acquainted with the matter, that although Ukraine and Russia had been in talks...

Read moreHamas Dismisses New Ceasefire Proposal

Hamas has dismissed all clauses of the latest hostage deal proposal, instead raising the number of Palestinian prisoners who have to be freed...

Read moreSwiss Homosexual Couple Abused Kids in LGBTQ+ Youth Group

Two Swiss homosexuals are accused of sexually abusing two 17-year-olds who joined an organization aimed at “helping” youngsters who think they are “LGBTQ+.”...

Read more