Wednesday is the 29th anniversary of the largest percentage sell-off of stocks in the history of Wall Street, including the sell-off that triggered the Great Depression on October 28, 1929. On that day in 1929, the Dow dropped 13 percent. In 1987, it dropped 22 percent.

Concerns abound about whether a repeat is likely to take place this month. Chartists are trotting out ominous parallels of today’s market to those prior to previous sharp declines. Others are noting that the market’s stupendous gains from the low in the spring of 2009 when the Dow bottomed at just over 7,000 to its present level of 18,250 (a gain of 11,175 points!) make it vulnerable to a correction — perhaps even a massive one.

It would indeed take a massive decline to make an October 2016 correction into the record books. But October is notable for sharp sell-offs, as Ryan Detrick, senior market strategist at LPL Financial, noted: “October has a reputation as a month you’d better buckle your seat belts.… Nearly all volatility [read: investors could lose lots of money] records seem to take place during this month.”

To equal Black Monday, however, the Dow would have to decline to 14,000 while the S&P 500, currently trading at 2,150, would have to drop to 1,675. And that would have to happen in one day.

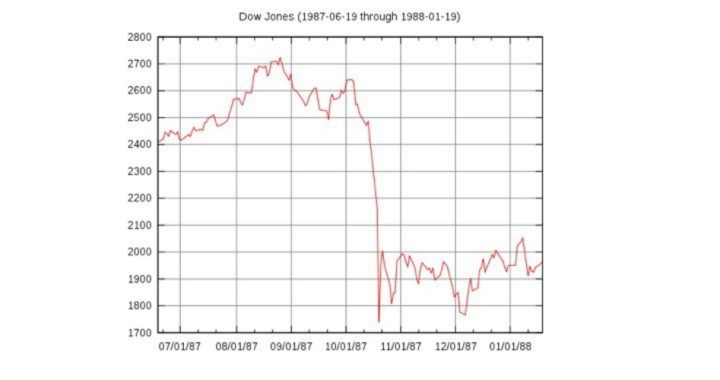

There are lots of reasons offered why the market might drop this month, but none of them herald the type of sell-off of 29 years ago. Back then the Dow hit a record high of 2,722 in August 1987, a 44-percent gain from the start of the year. Trouble in the Middle East and OPEC’s manipulation of the oil market caused the market to lose 3.8 percent of its value on Wednesday, October 14, before falling another 2.4 percent the next day. Following attacks on American-flagged ships off the coast of Kuwait, the market dropped further on Friday, losing another 105 points to close at 2,246.

Monday, October 19, investors sold all day, forcing the Dow down 508 points to 1,738, a loss of 22.61 percent for the day and 36 percent from the August high.

History records, however, that the Dow was back to pre-crash levels in less than two years, continuing the long bull market run dating back to 1979.

Today there are concerns, as there always are: Chartists getting nervous, a bull market getting long in the tooth, Middle East tensions building, earnings slipping, China’s economy slowing, and so forth. But a repeat of Black Monday is highly unlikely, especially with the emasculation of OPEC by American frackers. In fact, Mark Hulbert, long regarded as an accurate forecaster of market turns, just told his customers that, in his opinion, the stock market is setting itself up for a monster rally.

Investors are hoping he’s right.

An Ivy League graduate and former investment advisor, Bob is a regular contributor to The New American magazine and blogs frequently at LightFromTheRight.com, primarily on economics and politics. He can be reached at [email protected].