Five years ago this summer, former New Jersey Governer Jon Corzine’s high-risk futures and options trading company, MF Global, began having liquidity problems, thanks to risky trades that he had made with company money. When those trades began going sour the firm’s lenders starting issuing margin calls. When he couldn’t meet them, instead of admitting he’d erred by liquidating the failed trades and taking his losses, he simply called up the company’s treasurer and ordered her to raid customers’ accounts to meet the demands.

It’s one thing to risk one’s own money. It’s another thing entirely to push that risk onto unsuspecting and uninformed customers. Even worse, it’s wrong to lie that he never intended to do it.

Now Corzine will pay a small fine and move on.

The details of the final days of MF Global were spelled out by the New York Times last Thursday: “On the evening of October 27, 2011, Mr. Corzine was informed that while MF Global had plenty of available assets, only $82 million was in cash. The next morning he was informed that JPMorgan Chase, one of the firm’s [lenders], was seeking $134 million to patch an overdrawn account. Minutes later he told [the firm’s treasurer, Edith O’Brien] that meeting the bank’s demands was ‘the most important thing’ she could get ‘done that day.'”

That differs substantially, however, from the version that James Stewart provided to the Times in June, 2012: “That same day, the 28th, Mr. Corzine ordered Ms. O’Brien to transfer $175 million to JPMorgan to cover a firm overdraft. With no other source for the cash, Ms. O’Brien approved a transfer of $200 million for a customer’s trust account.”

When investigators sought testimony about that illegal transfer from Ms. O’Brien, she invoked the Fifth Amendment’s protection against self-incrimination.

The scam, funded by illegal transfers, continued until they couldn’t cover the shortfalls and on Sunday, October 31, the firm declared bankruptcy. Customers lost more than $1.6 billion and it took more than two years for the bankruptcy trustee to unravel all the deals. It took three more years to reimburse Corzine’s customers, using a combination of insurance proceeds and the sales of his company’s assets.

Without O’Brien’s’ testimony, investigators were stymied. All they heard from Corzine was that he never “intended” to steal his customers’ money. In December 2011 he told congressional investigators, “I never intended anyone at MF Global to misuse customer funds, and I don’t believe that anything I said could reasonably have been interpreted as an instruction to misuse customer funds.”

Investigators finally agreed to back off, charging Corzine only with negligence in failing to “diligently supervise” his company. The resultant fines and attorney’s fees — approaching $100 million — were paid by insurance.

That settled all claims, except one — the CFTC (Commodity Futures Trading Commission) lawsuit against Corzine, which was scheduled to begin in September. Heavy negotiations ensued with a final sticking point: Corzine demanded that any fine that the CFTC would levy against him was to be paid for by insurance, not by Corzine himself. The CFTC wouldn’t budge, Corzine relented, and is scheduled to pay the $5 million fine out of his own pocket.

He’ll scarcely miss it. When Goldman Sachs went public in 1999, Corzine, owning a massive share of the company as its chairman, pocketed an estimated $400 million. In addition to that, of course, was his salary, bonuses, and fees he took while presiding over MF Global prior to its downfall.

Today, prohibited by regulators from taking on any customer money, Corzine spends his days trading his own account from his office in New York City. No doubt he’ll consider the check he’ll be writing to the CFTC as just a cost of doing business.

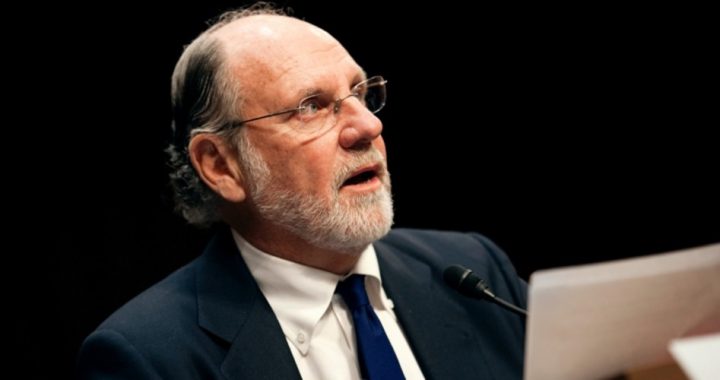

Photo of Jon Corzine: AP Images

A graduate of an Ivy League school and a former investment advisor, Bob is a regular contributor to The New American magazine and blogs frequently at LightFromTheRight.com, primarily on economics and politics. He can be reached at [email protected].