New York Governor David Paterson said in a radio interview on June 10 that his state might have to issue IOUs to pay its bills, or else face “anarchy in the streets.” The state faces a $9.2 billion deficit, and the legislature is two months late in voting on the budget. An actual shutdown of state services has been avoided, temporarily, by enacting temporary emergency spending bills. Even if the government shuts down, there is serious question about whether police, firefighters, prison guards and emergency and healthcare workers could continue to work without pay. “You could have anarchy literally in the streets if the government shuts down,” Paterson said.

Because states do not have access to a printing press, IOUs are the next best thing. Otherwise, taxes will have to be raised, and cuts in entitlements such as education, welfare benefits and healthcare substantially reduced. Several suggestions have been introduced by Paterson, but the Democrat controlled legislature prefers to kick the can. One of the largest programs, Medicaid, which costs the state about $1 billion every week, “should be cut another $400 million,” according to Republican Senate Minority Leader Dean Skelos. IOUs are only a temporary solution, and carry a high degree of risk: banks that do business with the state could reject them as they did during Democratic Governor Hugh Carey’s administration in the 1980’s.

The governor, however, has found another way to “paper over” the shortfall: borrow from itself. In the New York Times on Friday Paterson announced a tentative agreement to borrow nearly $6 billion from the state pension fund, with the promise that the state will pay the fund back in the future. “It’s a classic Albany example of kicking the can down the road,” said Harry Wilson, the Republican candidate for state comptroller. As the Times article stated, “In a classic budgetary sleight-of-hand, they will borrow the money to make the [state’s required] payments to the pension fund.” Under the plan, the state and various municipalities would borrow the money to reduce their pension contributions for the next three years in exchange for making higher payments over the next ten years after that. And they wouldn’t have to start making any principal or interest payments until 2013. By that time, Paterson hopes, the pension plan’s investments in the stock market will have rebounded enough to reduce those payments.

The state budget director Robert Megna declared that “We’re not borrowing.” And then he backed off: “I’m not going to sit here and characterize it as not a borrowing. But it is an annual, relatively small borrowing…” The governor called this borrowing “a last resort. I have never said I wouldn’t borrow.” Gary North called it “blazing a new trail,” by which “creative finance has taken another leap forward…This will not actually solve the statistical problem [of entitlements].” As the Times said, “the state and municipalities will have to make higher minimum payments into the pension system during bull markets to mitigate the impact of market crashes.” Which is precisely the remedy recommended by John Maynard Keynes in 1936, which justified deficit spending during recessions, as long as surpluses were generated (and not spent) during the fat years.

If all of these fiscal and financial shenanigans succeed in buying time, all it does is put off the day of reckoning. In a recent article in the Times Review of Books, former Fed Chairman Paul Volcker said such tricks “can buy time, but not indefinite time…underlying hard fiscal and economic adjustments [read: tax increases and spending cuts] are necessary.”

In a lengthy presentation for the Peterson Institute for International Economics, Harvard economics professor Niall Ferguson reminded his audience that borrowing was first invented by the Italians as the “best [way] to finance government undertakings of an extraordinary nature, like wars, by borrowing from citizens rather than by taxing them.” He went on to point out that there are “six ways out” for any entity finding itself in the same position as New York:

1. Generate a higher growth rate of GDP

2. Arrange a lower rate of interest on the government’s debt

3. Arrange a bailout from some external source

4. Fiscal pain: increase in taxes and/or a cut in public spending

5. Print paper money to pay the government’s bills

6. Default, including repudiation, standstill, moratorium, restructuring, rescheduling of interest or principal payments, etc.

Realistically, however, for a state like New York, only Number 4 and Number 6, provide “a way out.” And since legislators in New York, and elsewhere, have no interest (pun intended!) in facing the music, but would rather kick the can, then defaulting on its promises not only is the only way out, it is in fact already being implemented by its changing the terms of the deal and “borrowing from itself.”

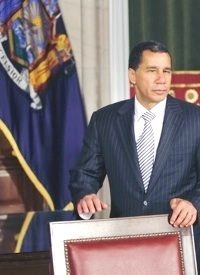

Photo: New York Governor David Paterson: AP Images